NEW DELHI: PE firm Tillman Global Holdings (TGH) is in negotiations to invest $4-6 billion (around Rs 35,000-52,800 crore) in Vodafone Idea (Vi) and take operational control of the cash-strapped and loss-making telecom operator, people aware of the matter said.

The investment, however, will happen only if the government provides a comprehensive package covering all the liabilities of Vi, including dues based on adjusted gross revenue (AGR) and spectrum payments.

“If the deal happens, TGH will take the promoter status and take control from existing promoters Aditya Birla Group and UK’s Vodafone,” said one of the people. The Indian government — telco’s largest shareholder with a nearly 49% stake — will stay a passive minority investor, he said.

Operational Expertise

The New York-based investment firm is not seeking a waiver of all dues, but a restructuring of the liabilities that will give some breathing space to the company, and has submitted a detailed proposal to the government, the people said.

“The proposal from TGH would be in conjunction with the dues being resolved. The restructuring package sought by the firm would be conditioned on its investment and its investment would be conditioned on the waiver package,” said the person quoted earlier.

In case the government provides a relief package to Vi, a deal may be finalised in the coming months.

“From the government’s perspective, it’s not about just providing a waiver, but how can a waiver be given in conjunction with bringing investment and operational expertise,” said another person involved in the discussions.

The people spoke on the condition of anonymity as the talks are private.

Queries sent to TGH, Aditya Birla Group and Vodafone Group Plc remained unanswered at the time of going to press Sunday.

TGH invests in the high growth sectors of digital and energy transition infrastructure. It has expertise and fundamentals to run a telecom operator as its chairman and chief executive Sanjiv Ahuja was credited for the turnaround of French telecom giant Orange during 2003-2007. TGH has investments in telecom infra including fibre and tower assets across countries.

TGH had previously held discussions for about 18 months over an investment in Vi. It backed out when Vi decided to raise funds by selling shares to institutional investors last year as the PE firm felt it was not a good deal. Talks have picked up again in recent months, said the people.

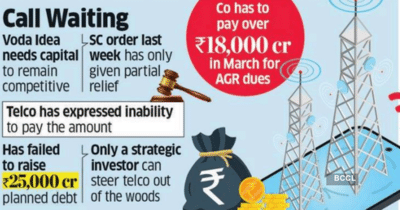

Vi had raised `24,000 crore via a mix of follow-on and preferential issues of shares last year, but the funding failed to steer the company out of the woods. It has also been unable to raise the planned Rs 25,000 crore debt.

ET reported in September about the government’s plan to bring in a strategic investor who can put in capital and run the telecom company.

EXIT ROUTE

An investment by TGH would give promoters the option to dilute their stake and exit. The government’s stake would also be diluted at the time of investment, and then it would have the opportunity to convert more financial arrears into equity maintaining a stake no more than 49%.

Currently, the government owns a 48.99% stake in Vi, having converted some of its past dues into equity. The Aditya Birla Group and Vodafone hold 9.50% and 16.07%, respectively.

The telco needs a lifeline by this fiscal year-end, when it will have to start repaying thousands of crores of statutory AGR dues. While the Supreme Court has provided relief to Vi last week, there is confusion if the order applies to all the AGR dues or only the additional demand of around Rs 9,000 crore.

DOT OPTIONS

The Department of Telecommunications had earlier prepared a few options to provide relief to the telco on outstanding regulatory dues of Rs 84,000 crore, including interest and penalties, after Vi expressed its inability to pay.

The investment, however, will happen only if the government provides a comprehensive package covering all the liabilities of Vi, including dues based on adjusted gross revenue (AGR) and spectrum payments.

“If the deal happens, TGH will take the promoter status and take control from existing promoters Aditya Birla Group and UK’s Vodafone,” said one of the people. The Indian government — telco’s largest shareholder with a nearly 49% stake — will stay a passive minority investor, he said.

Operational Expertise

The New York-based investment firm is not seeking a waiver of all dues, but a restructuring of the liabilities that will give some breathing space to the company, and has submitted a detailed proposal to the government, the people said.

“The proposal from TGH would be in conjunction with the dues being resolved. The restructuring package sought by the firm would be conditioned on its investment and its investment would be conditioned on the waiver package,” said the person quoted earlier.

In case the government provides a relief package to Vi, a deal may be finalised in the coming months.

“From the government’s perspective, it’s not about just providing a waiver, but how can a waiver be given in conjunction with bringing investment and operational expertise,” said another person involved in the discussions.

The people spoke on the condition of anonymity as the talks are private.

Queries sent to TGH, Aditya Birla Group and Vodafone Group Plc remained unanswered at the time of going to press Sunday.

TGH invests in the high growth sectors of digital and energy transition infrastructure. It has expertise and fundamentals to run a telecom operator as its chairman and chief executive Sanjiv Ahuja was credited for the turnaround of French telecom giant Orange during 2003-2007. TGH has investments in telecom infra including fibre and tower assets across countries.

TGH had previously held discussions for about 18 months over an investment in Vi. It backed out when Vi decided to raise funds by selling shares to institutional investors last year as the PE firm felt it was not a good deal. Talks have picked up again in recent months, said the people.

Vi had raised `24,000 crore via a mix of follow-on and preferential issues of shares last year, but the funding failed to steer the company out of the woods. It has also been unable to raise the planned Rs 25,000 crore debt.

ET reported in September about the government’s plan to bring in a strategic investor who can put in capital and run the telecom company.

EXIT ROUTE

An investment by TGH would give promoters the option to dilute their stake and exit. The government’s stake would also be diluted at the time of investment, and then it would have the opportunity to convert more financial arrears into equity maintaining a stake no more than 49%.

Currently, the government owns a 48.99% stake in Vi, having converted some of its past dues into equity. The Aditya Birla Group and Vodafone hold 9.50% and 16.07%, respectively.

The telco needs a lifeline by this fiscal year-end, when it will have to start repaying thousands of crores of statutory AGR dues. While the Supreme Court has provided relief to Vi last week, there is confusion if the order applies to all the AGR dues or only the additional demand of around Rs 9,000 crore.

DOT OPTIONS

The Department of Telecommunications had earlier prepared a few options to provide relief to the telco on outstanding regulatory dues of Rs 84,000 crore, including interest and penalties, after Vi expressed its inability to pay.

You may also like

Ladakh LG calls on Defence Minister, discusses humanitarian assistance & air connectivity for UT

Rohit Sharma's doppelganger trains Harmanpreet Kaur for iconic World Cup trophy walk - WATCH

Pensioner 'heartbroken' as she watches £1m home in UK seaside town torn down

Arsenal braced for Bayern Munich suspension blow as huge Mikel Arteta worry clear

Four in ten Brits living in 'stress-inducing' levels of clutter but 1 thing could help