PhonePe has filed its DRHP with the SEBI via the confidential route for an up to $1.5 Bn public listing. As the fintech juggernaut heads to the D-Street, will PhonePe’s UPI dominance be enough to command a $15 Bn valuation, especially when it is still loss-making?

Losses Loom Large: With a listing slated for early next year, PhonePe is still nowhere close to profitability. While its losses shrank (13.5% YoY to INR 1,727 Cr) and margins improved in FY25, the fintech major still burns significant cash compared to rival Paytm, which achieved profitability in Q1 FY26. As a result, questions linger over PhonePe’s unit economics, the high valuation and over-dependence on UPI.

The Gilded Payments Cage: PhonePe may command 46% of the UPI market, but its dominance is built on razor-thin margins from payments. Since merchants pay zero fees (for now), the company makes little from online payments and instead relies on interchange fees and soundbox subscriptions. This dichotomy highlights the limits of PhonePe’s scale.

Adding to the challenge are regulatory setbacks — from the real-money gaming ban to multiple GST notices for merchants — which have also dented UPI volumes as a whole.

Diversification Games: PhonePe has spent the past few years building a diversified playbook. Yet, despite its data, network effects and NBFC advantage, the fintech major has failed to convert its high customer engagement into robust lending models and efficient acquisition funnels.

What complicates matters is that its other businesses like Pincode for quick commerce, the Indus Appstore and Share.Market for investments, operate in segments that are overcrowded and dominated by deep-pocketed players. PhonePe enjoys an advantage of scale over many of its rivals, at least as far as payments is concerned, but competing on all these fronts will take a lot out of the company.

Now, as PhonePe steps into the limelight of public markets, will its UPI dominance prove strong enough to convince the public markets? Let’s find out…

From The Editor’s DeskRapido Eyes $550 Mn: The ride-hailing unicorn is looking to raise the mega round in a mix of primary and secondary deals. While Prosus is expected to pump in $250 Mn, the remaining will come from WestBridge. This follows Swiggy announcing plans to dump its stake in Rapido.

Emergent Nets $23 Mn: The agentic AI startup has raised the funding in its Series A round led by Lightspeed. Founded in 2024, the startup provides a platform that allows users to build production-ready apps autonomously using AI agents.

Allen Hires Ex-Zomato CEO: The coaching giant has roped in Rakesh Ranjan as the new CEO of its digital arm. Ranjan, who quit Zomato in April this year, succeeds Abha Maheshwari, who stepped down from the role of Allen Digital CEO last month.

PharmEasy Bags INR 1,700 Cr Debt: The epharmacy giant’s parent API Holdings has raised the funds via NCDs to pay off existing debt obligations worth INR 1,545 Cr. The company did this by pledging 61% of its stake in diagnostic chain Thyrocare to Catalyst Trusteeship.

Good Capital’s $30 Mn Fund: The VC firm has marked the final close of its second fund, which largely saw commitments from family offices across Asia and Europe. The fund aims to write up to $1.5 Mn in cheques to back AI-first startups in the country.

Gullak Nets $7.5 Mn: The investment and saving platform has raised the capital in its Series A round led by Chiratae Ventures and other existing investors. Founded in 2022, the startup helps users invest in digital gold and silver.

Centre Vs X: Karnataka HC has dismissed the social media platform’s petition, which challenged takedown orders issued by the government. The court observed that the constitutional protection of free speech is only available for Indian citizens, not foreign entities.

Oolka Nets $7 Mn: Former Meesho executive Utkrishta Kumar’s new AI-led fintech venture raised the funding in a seed round co-led by Lightspeed India and Z47. Oolka’s AI agents help users track their credit scores. It also operates a lending marketplace.

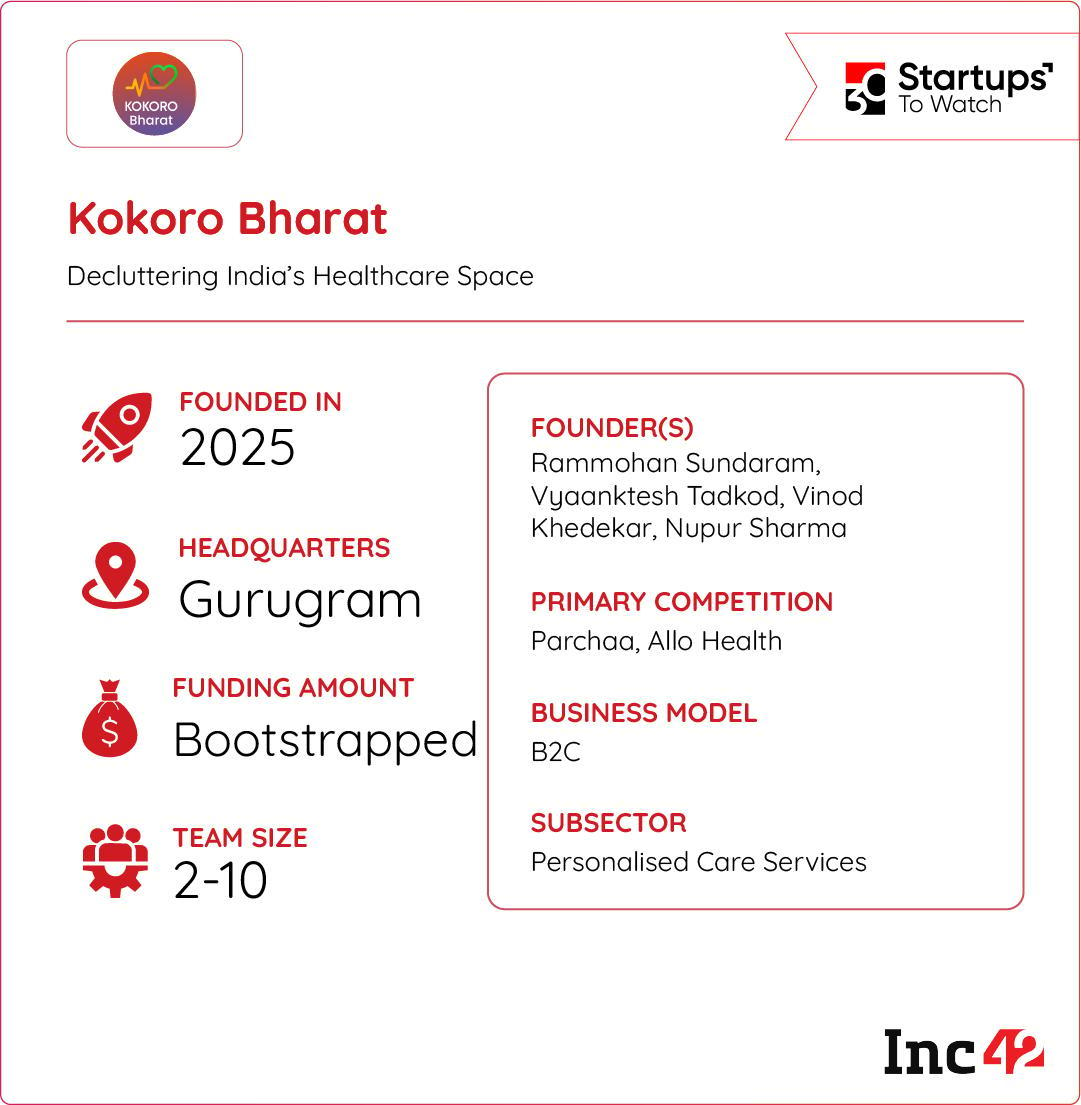

Inc42 Startup Spotlight Can Kokoro Bharat Become India’s Healthcare Super App?India’s healthcare landscape is a maze of fragmented services – from insurance and consultations to overall wellness and medical recordkeeping. This challenge is particularly acute in rural areas, where over 70% of India resides with limited access to health infrastructure.

Stepping in to solve this problem is Kokoro Bharat, which aims to build a unified, accessible digital health ecosystem for all.

A One-Stop Solution: Founded earlier this year, Kokoro Bharat is an all-in-one super app for everything healthcare. The platform seamlessly integrates a wide array of services, including home care, insurance claims, and sexual wellness, into a single, user-friendly interface.

Empanelled under the Ayushman Bharat Digital Mission (ABDM), the platform allows customers to securely store and access their medical records, prescriptions, and lab reports, streamlining their interactions with the healthcare system.

Bridging The Healthcare Gap: By aligning with the government’s push for nationwide ABDM adoption, Kokoro Bharat aims to become a central hub for healthcare access. Its integrated model not only offers convenience for urban users, but also holds the potential to bridge the significant healthcare gap in rural India.

With the homegrown healthtech market projected to cross the $50 Bn mark by 2033, can Kokoro Bharat declutter India’s healthcare space?

The post PhonePe’s IPO Puzzle, Rapido’s Next Move & More appeared first on Inc42 Media.

You may also like

Ladakh protest: Farooq Abdullah urges Centre to initiate talks; warns of China threat

Red Roses 'will not overthink' World Cup final with sold out crowd to be '16th player'

Prince Andrew biographer tears into Sarah Ferguson with dire warning over Epstein email

'Unclog arteries' with red juice that lowers blood pressure and cholesterol

Now you can get your Aadhaar card on WhatsApp, learn the easy way.