Simpl is grappling with an existential crisis. The Reserve Bank of India (RBI) has directed the buy-now-pay-later (BNPL) platform to cease all payment-related operations. So, why did the RBI crack down on Simpl?

The Regulatory Strike: As per the company, the RBI determined that Simpl’s business model constituted a “payment, clearing, and settlement” system. As the startup does not hold a licence under the Payment and Settlement Systems Act, the regulator has ordered it to stop operations altogether.

In essence, RBI has now classified Simpl’s BNPL-centric checkout tool as a payment system, making the platform liable for compliance with the central bank’s payments licensing rules.

The Aftermath: As the BNPL platform scrambles to chart its next move, it has much on the line. A protracted licensing process could have far-reaching consequences – a complete freeze for its 26,000 merchants and 7 Mn users, that too during a festive sales season, and venture capital investment of over $83 Mn in jeopardy. Not to mention, the livelihoods of its nearly 150 employees, now under threat.

The clampdown follows the ED’s complaint in July that Simpl had flouted foreign exchange norms to the tune of INR 914 Cr and accused it of misrepresenting itself as an “IT and technology services”. With its core operations now frozen, is this a temporary regulatory hurdle for Simpl or a fatal blow? Let’s find out…

From The Editor’s DeskAmazon’s Quick Commerce Gamble: Amazon Now has arrived in Mumbai just ahead of the festive season, aiming to capture high-frequency shoppers. With 10-minute delivery, dark stores, and Prime integration, Amazon is playing catch-up in India’s fierce quick commerce race.

Swiggy’s Instamart Hive Off: The foodtech giant’s move to spin off the quick commerce arm as a separate subsidiary hints at efforts to sharpen its focus and ensure operational flexibility. Instamart is also likely to go for fundraising as it weighs moving to an inventory-led model.

Zappfresh Decked Up For IPO: In the run-up to its BSE SME IPO, the D2C meat delivery company raised INR 16.8 Cr from anchor investors. The company allocated 16.7 Lakh equity shares to anchor investors at INR 101 apiece, the upper end of its IPO price band.

Handpickd Nets $15 Mn: Milkbasket founder Anant Goel’s ecommerce startup has raised around INR 133 Cr in its Series A round led by Bertelsmann India Investments. Currently operational in three cities, Handpickd sells fresh fruits and vegetables via its platform.

Meet Peak XV Surge’s Cohort 11: The VC firm’s seed stage platform has selected 23 startups from India, US and South East Asia as part of its eleventh cohort. Aligning with recent startup trends, most of the cohort features ventures hailing from AI, fintech and D2C.

WROGN’s FY25 Losses Zoom: The Virat Kohli-backed D2C fashion brand’s net loss jumped 32% to INR 75.5 Cr in FY25 from INR 56.8 Cr in the previous fiscal year. Partly to blame for this was declining operating revenue, which slipped 9% YoY to INR 223.2 Cr.

Decoding Purple Style Labs’ DRHP: The luxury fashion house’s 441-page draft IPO document gives a sneak peek into the company’s shareholding pattern and key executives. Unlike many new-age tech startups, PSL is not heavily backed by large institutional investors.

Zeropearl Closes $18 Mn Fund: Titan Capital’s ex-managing partner Bipin Shah-led micro VC firm has announced the final close of its maiden fund. The fund plans to invest in 45 early-stage startups across multiple sectors.

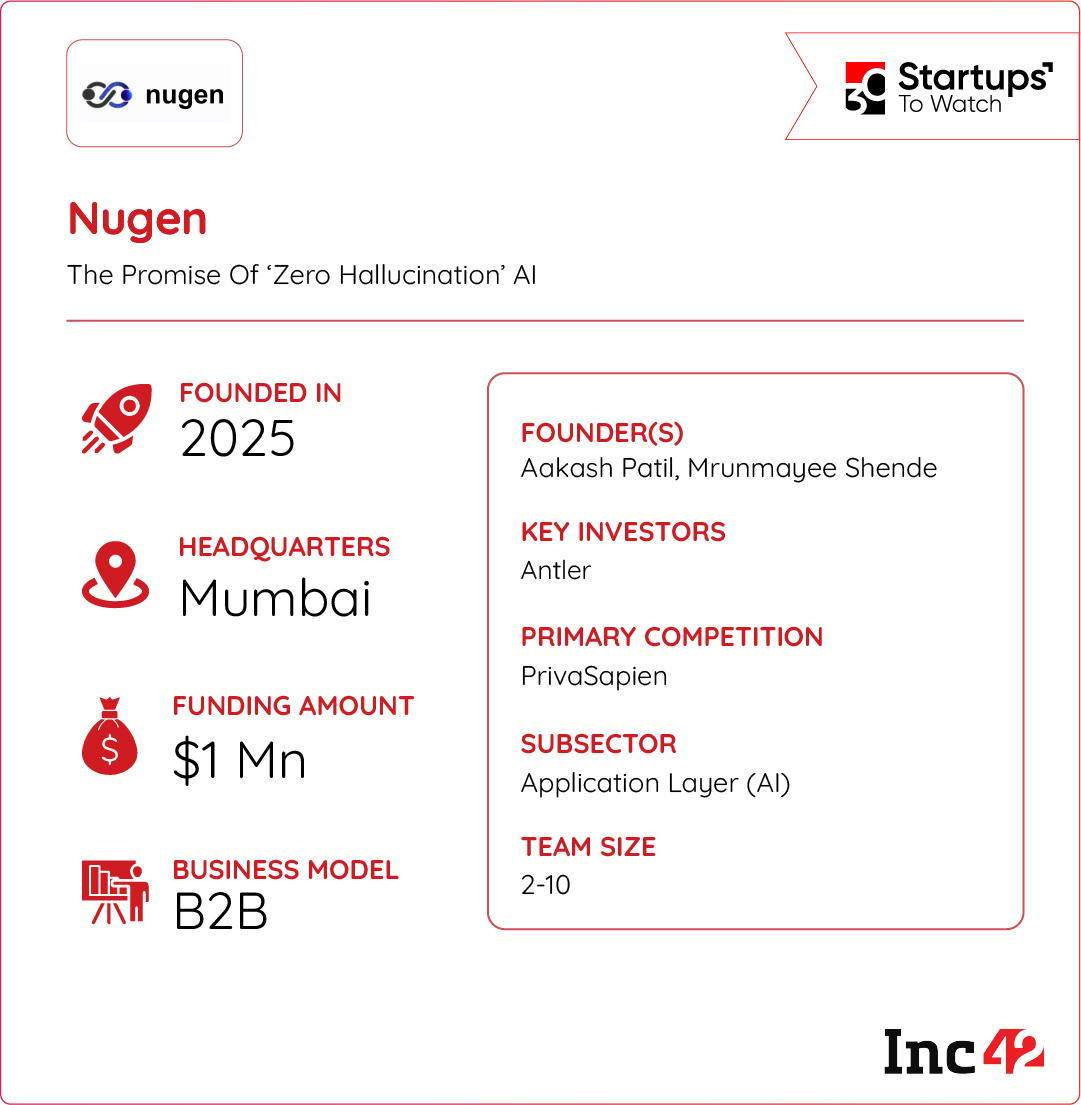

Inc42 Startup Spotlight Can Nugen Make AI Truly Trustworthy?AI today faces a major challenge — reliability. Hallucinations, inaccurate outputs, and misfiring models make many businesses hesitant to adopt it, especially in high-stakes sectors like law, governance, and finance, where accuracy and trust are non-negotiable.

To address this, Nugen is building proprietary AI technology designed for reliable, trustworthy performance in complex industries.

Building Reliable AI: Nugen’s models come with built-in reliability scores and confidence indicators, and its solutions support cloud, private cloud, and on-premises deployment. They integrate with existing enterprise systems via secure APIs, ensuring enterprise-grade security. Nugen is also investing in AI interpretability and alignment research, making its models safer, transparent, and business-ready.

The Big Opportunity: With enterprises increasingly exploring AI but wary of its limitations, there’s a growing demand for trustworthy, reliable AI. Nugen is positioned to capture this market by delivering enterprise-ready AI that mitigates risk and builds confidence in mission-critical operations.

By combining reliability metrics, secure deployment options, and a focus on interpretability, can Nugen address a key gap in enterprise AI?

The post Simpl In RBI’s Crosshairs, Amazon’s New Gamble & More appeared first on Inc42 Media.

You may also like

Want to bring a dog to this Italian city? That'll be $1.75

Live ammunition used against Nepal protesters, forensics show

Amy Dowden's heartwarming gesture from Strictly judge as she lifts the lid on friendship

Jessie J issues savage response to very awkward fan question in gym

Premier League icon surprised by Man Utd transfer snub - 'He wanted to leave'